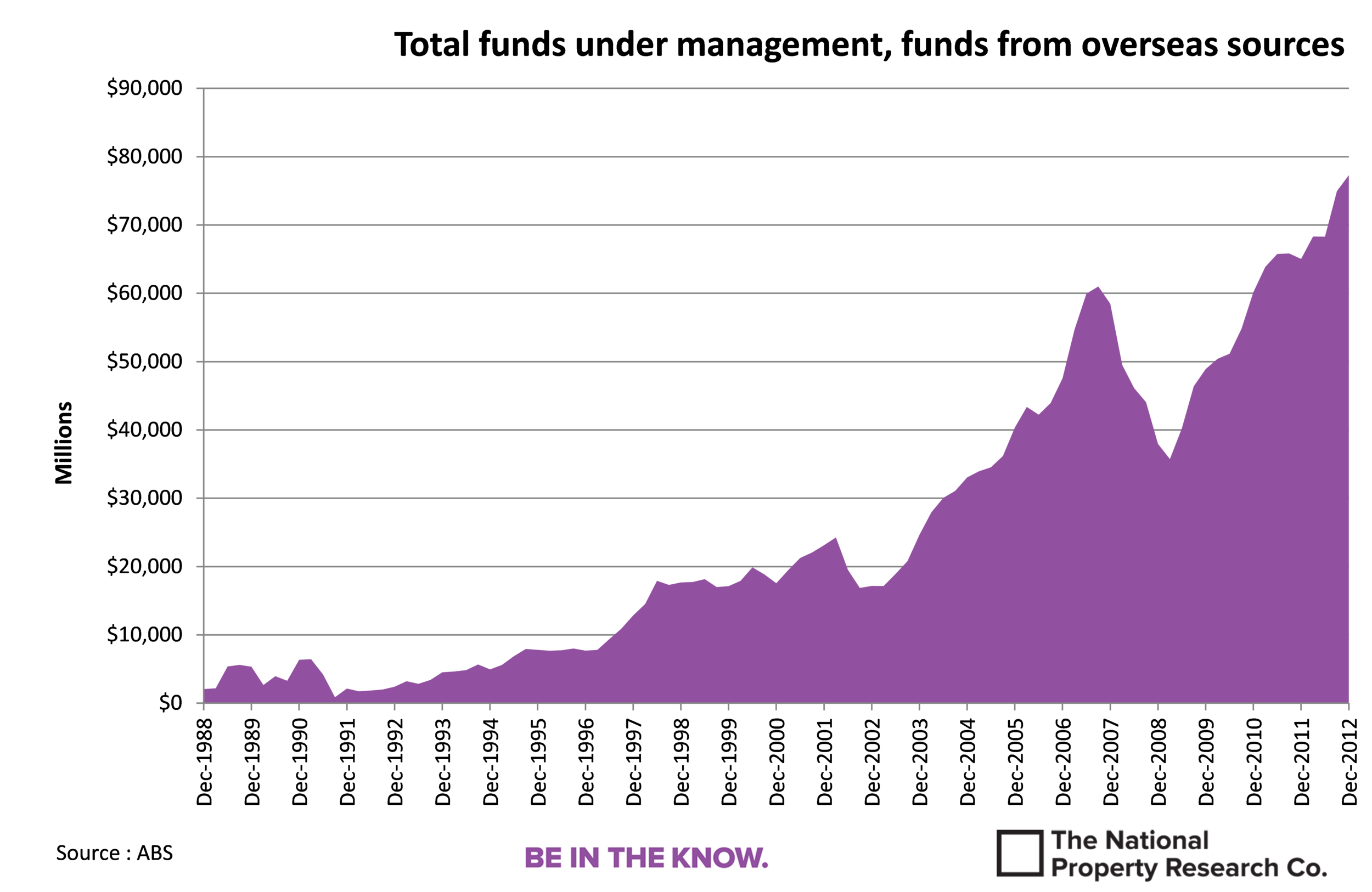

Foreign Investment in Australia at Record Levels

The expression of “not being able to see the forest for the trees” probably rings true for many Australians. We all get caught up in our own little world that sometimes makes stepping back and looking at the big picture difficult.

Despite recent political events, the world does look at Australia with a high degree of certainty and an expectation of stability. It is these traits that continue to see foreign investment into Australia soar to record levels. Whilst there was some concern surrounding the period of the GFC, Australia conducted itself in such a manner as to prove that it was worthy of significant foreign investment. Our banking and property sectors proved to be highly resilient, a fact not lost on many throughout the world.

Whilst most Australian’s have grumbled at our higher interest rates when compared to many advanced economies, this was also a significant factor in attracting that investment to Australia. Without foreign investment in Australia, a great number of projects would never have gotten off the ground. Those higher interest rates have also provided a cushion for the RBA to both stimulate and slow the economy.

The value of funds under management from overseas investors increased by $2.3 billion from the September quarter 2012 to the December Quarter 2012. This was an increase of roughly 3.0%. which is extraordinary in its own right. There is an expectation that the data will likely increase by a similar amount throughout the first quarter of 2013 as interest rates remain largely unchanged.

There are however potential clouds on the horizon. As many of the developed countries start to show signs of recovery (a healthy thing for the world) their central banks will increase interest rates. The result is that the volume of funds finding its way to Australia may moderate, particularly on the back of potentially better returns to be found elsewhere. Capital is incredibly liquid on the world stage and if the decision making process gets bogged down, capital will find another place to invest. This could flow through to fewer investment funds having the opportunity to use foreign capital to fund projects. It may also see the grass roots level of international buyers for investment properties prove to be more cyclical than current conditions and commentary would dictate.

One aspect of the market that has not gained substantial traction in the post GFC environment has been the return of the mortgage funds. Unfortunately many were lost to the events of 2008 and post. However this remains an opportunity to take on the broader financiers given that the banking/finance sector has contracted in terms of the number and size of the players. This has created all sorts of difficulties for the traditional banking sector that has regulated balance sheet weightings that need to be adhered to. Mortgage funds have the potential to add greater competition which is better for the consumer and the broader industry. This boutique end of the market has a real place for both the investment community and the project community.

Whilst there has been mixed press surrounding foreign investment in Australia, it is something that we should not take for granted. It remains a vote of confidence in the general economic soundness of our country and the opportunities that are both perceived and reality. The prospects that flow from having greater volumes of funds streaming into Australia rather than relying on the small national population of 23 million people to stump up the cash is a benefit we should be grateful for.

The National Property Research Company

Level 1, 307 Queen Street

BRISBANE QLD 4000

Ph 07 3229 0111