What Drives Residential Property?

The answer is really very simple, people. If the population is growing faster than supply, then the market moves into a position of under supply where prices for both purchasers and renters escalate. Conversely, when the supply exceeds the population growth, the market moves into a position of over supply and prices typically track sideways or fall, along with rents. In reality, the time at which a market stays in equilibrium is often inherently short by contrast.

So if people are driving the demand for housing, what does Australia look like? Whilst we are experiencing a period of unprecedented population growth nationally; it is far from being distributed evenly. It is these demographic dynamics that are really shaping the growth, or lack thereof in many of the states.

Natural Growth

Natural Growth by State - QTR 4: 2015

Natural growth has some very interesting trends emerging for the December Quarter of 2015. Although Queensland is the third largest population in Australia, the number of births minus deaths places the state as the second fastest growing in the country. This is hardly a reflection of the slightly younger age composition of Queensland given that the difference between Queensland and Victoria is one year, at 36 and 37 respectively. It does however suggest that the ‘Family Formation Stage’ within the Sunshine State is out performing on a per capita basis. It also suggests that some of our town planners might want to reconsider just how we house the population and whether the current infill push is balanced against the demographic trends, a topic in its own right.

International Migration

International Migration by State - QTR 4: 2015

One of the biggest drivers in the nation for population growth is international migration. Throughout the resources boom there was a significant push for 457 visas, which swelled the population of both Queensland and Western Australia. However, this growth was largely short term and prone to the cycles around significant infrastructure construction projects.

There is no mistaking that Sydney does represent Australia’s true International City and subsequently achieves the lion’s share of international growth. With this growth comes a very strong correlation to the business sector. Melbourne, whilst following close behind, is typically fuelled more significantly by education as well as business. It is this education sector that Queensland is trying to tap into with a very strong growth profile for student accommodation in Brisbane. The Brisbane City Council has been highly successful in providing the stimulus to attract student accommodation. The real issue is now attracting the students to fill them and the Universities to grow their education footprint in order to drive that demand.

The real losers in this space are both the Northern Territory and to a lesser extent, the ACT. Slight population losses in the NT can largely be explained by large infrastructure projects, particularly those LNG related, coming to a close.

Interstate Migration

Interstate Migration by State - QTR 4: 2015

This graph tells a very important story. Firstly, NSW is always in a net deficit position, this should not be alarming to anyone…perhaps with the exception of the NSW government that would love to turn this trend around. However the devil really is in the detail.

QLD and WA's Net Interstate Migration

The wheels started falling off the Perth residential market in 2015, though the trend is significantly more pronounced in 2016. We suspect that the 2016 data will actually show the problem of net interstate migration losses increasing, not decreasing. Certainly this has been the experience on the ground with sales rates across all residential sectors feeling the bite of a slowdown in the resources sector tied to depressed commodity prices.

On the contrary, QLD which has been through a similar cycle to W.A, has been able to rely on a greater proportion of the economy being diversified into construction and tourism. Both cycles being somewhat intrinsically linked outside of the resources sector. By contrast, there is an expectation that regional centres such as Townsville, Mackay, Rockhampton and Gladstone would have experienced intrastate and interstate migration losses. However, the arguably more diverse SEQ economy has been sufficiently robust to help the state grow. There is an expectation that this is likely to continue through to 2018 for the Commonwealth Games, Queen’s Wharf and other major infrastructure projects transform the corner of the State.

The population shift to Queensland, albeit lagged from when we thought it would occur, may well be starting to form around our more affordable accommodation and arguably better outdoor lifestyle. When the headlines read that Queensland has gone against its long term trend by having two days of winter, the point is well made. However the real pull factor is housing at almost half the price of Sydney and a lifestyle similar to Perth. The similarities between Brisbane and Perth are one of the reasons Brisbane is gaining from the ‘west to east’ population migration. If the Queensland economy was stronger, the population floodgates would be well and truly open.

Despite this, the real mover and shaker in the population space has been Victoria. This strong net interstate migration growth combined with sturdy international migration numbers, has created the opportunities for Melbourne to become one of the most vibrant urban centres in Australia.

VIC's Net Interstate Migration

However it has not stopped an overbuilding of apartments and land estates selling more than two years into the future. If there were any causes for concern in the property and construction industry, those two points alone would rate right up there as clouds building on the horizon, pardon the pun.

So What Do The State's Look Like?

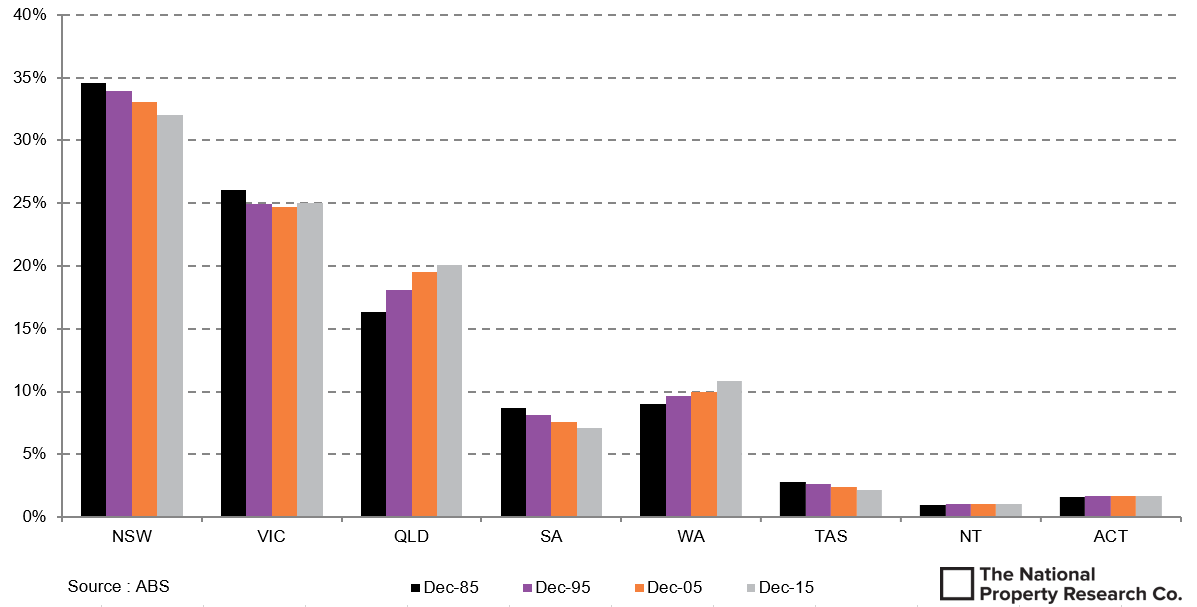

There has been quite a lot of press suggesting that the population of Melbourne will overtake Sydney. This conversation always comes around when Melbourne’s growth is higher than its longer term trends. The reality though is really quite different. The graph below provides a snapshot across three decades of the marketshare of population for each State.

Despite the short term low population growth currently being experienced by Queensland and Western Australia, the longer term trends clearly demonstrate that both of those states are growing and achieving a greater share of the nation’s growth. A reversal in these trends is only likely to occur if Victoria continues to gain through interstate and international migration and NSW can turn around its persistent net interstate migration losses. This is expected to be an unlikely scenario in the short to medium term.

Australia's Population Market Share by State

Perhaps the states which do start to create some questions around long term opportunity are South Australia and Tasmania. Given some of the comments on election night about the lack of love for the Coalition from the Tasmanian representatives, if they don’t hold the balance of power, those comments may have been better left unsaid. Federal funding is often critical for getting major projects across the line, a challenge not made any easier when navigating through opposing or hostile camps.

The challenge for the property industry is make sure that the cycles do not get out of hand. The risk of oversupply, despite better information, has been made worse through the varied channels that property is now sold. Many financial institutions have also compounded this position by only looking at the capacity to make presales and settlements. There is very little care on their behalf if the market is saturated, so long as the debt is serviced or repaid. The retail arm may think differently and it is this position of tension that is often a challenge to manage.

Despite all of this, it is people that make the residential cycles happen. Without people there isn’t a buyer, owner occupier or tenant; a simple fact somewhat lost in certain parts of the country. However, the charts above should at least put the spot light on where the growth is happening and what states are having the best of the current demographic trends.

The NPR Co. is a truly independent Property Economics and Research House. Contact us today to help with your next project, marketing or acquisition. We are experts at identifying strategies to help mitigate risk whilst enhancing profitability.