Fact or Fiction...

At The National Property Research Co. we are incredibly fortunate with the diversity of work we conduct and the clients we act for. However at this stage of the property cycle, the level and depth of manure being pushed is out of all proportion to the risk and reward. In sixteen years of researching the property market we have seen a lot. Much of it outstanding with truly visionary thinking and execution. This rant is simply pulling a thorn from the side and feeling better for it. The property industry is a wonderful industry and one that has been good to many of us. In football terms, “it is bringing the game into disrepute” that irks me. The absolute disregard for the end user by some parties and the misinformation is enough to make an old researcher shake his head in utter disbelief.

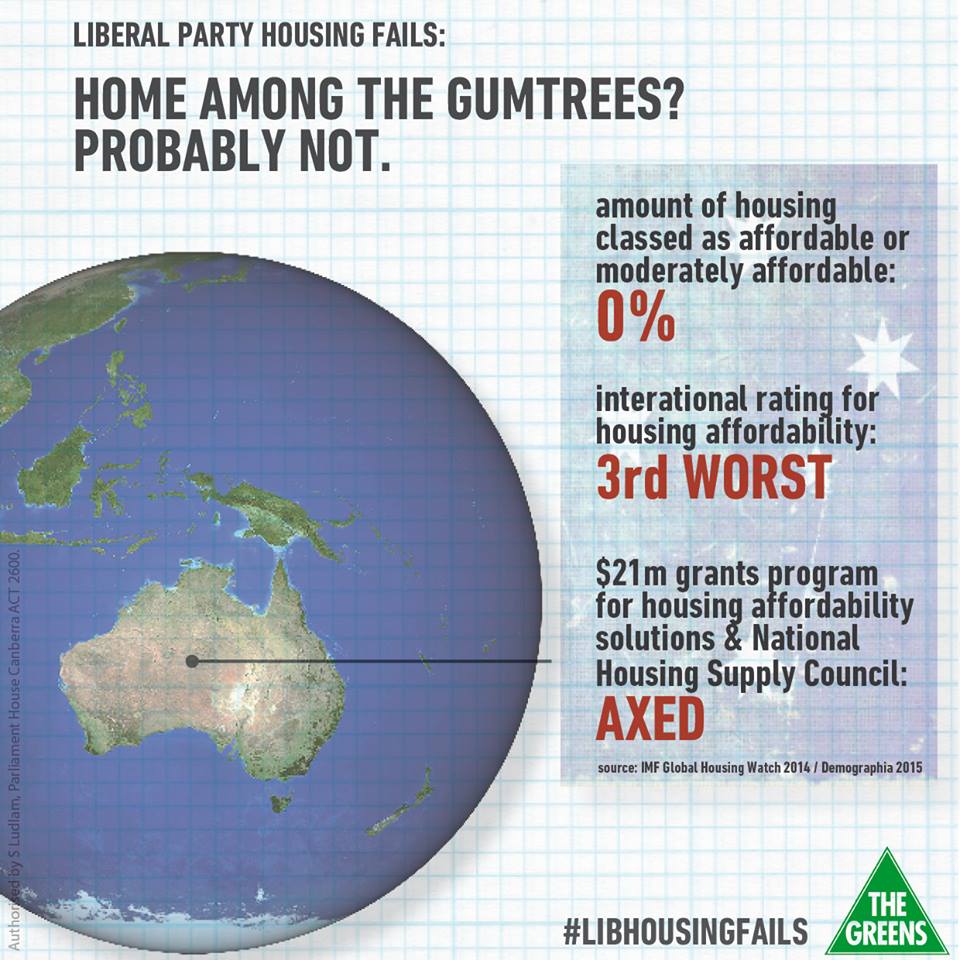

This was taken from Greens Senator Scott Ludlam’s Facebook page. To his credit, he has 89,000 followers but here is the rub. If you look at the above info-graphic, apparently Australia has absolutely no housing that is classed as affordable or moderately affordable. The IMF Global Housing Watch stated, “In other countries where housing markets have rebounded, IMF assessments point to modest overvaluations in Canada and Israel and more substantial overvaluations in Norway and Sweden (Table 1).4 In many cases, the house price booms are restricted to particular cities (in Australia and Germany, for example) or are amplified by supply constraints (New Zealand for example).” That says particular cities, not the whole of Australia.

“...the affordability of housing is overwhelmingly a function of just one thing, the extent to which governments place artificial restrictions on the supply of residential land. Australia is perhaps the least densely populated major country in the world, but state governments there have contrived to drive land prices in major urban areas to very high levels, with the result that in that country housing in major state capitals has become severely unaffordable...” Dr Donald Brash, Former Governor of the Reserve Bank of New Zealand made those comments in 2008. We would argue those comments are still largely accurate today. In the latest version of the report that is quoted in the infographic, on the same page it notes that Australia does in fact have affordable housing which is defined as less than three times the multiple of one’s earning’s to the median price. Moderately unaffordable is between 3.1 and 4.0 times ones annual earnings. The report is being misquoted for political gain.

Providence Ripley

Whilst we would suggest that the methodology being adopted in the report is flawed, the fact is the political spin being pushed is blatantly wrong and fails to address the real problems. A more realistic approach to affordability looks at the percentage of income required to service a mortgage or weekly rent and the impact that interest rates, unemployment rates etc have on that individual’s capacity to service said debt. Not all communities are homogenous, politicians of all people understand this…again making the above infographic ludicrous. Affordability is often related more to life stage than simply looking at earnings multipliers and median house prices.

Ecco Ripley

he fact that Federal Housing grants have been axed is a problem for many people in the community. However if you take away negative gearing as a tax mechanism, the supply of housing into the market will dwindle significantly in the short term. This will drive up rents and make un-affordability skyrocket. The private sector has taken over from the government in supplying housing to the community with approximately 50% of housing finance now going to the investment community. Any talk of taking away negative gearing would see taxes to the general populace increase as the government would again find itself in the position of land lord. Been there, done that and didn’t like it. Economically it doesn’t make sense for the government. The private sector is much more efficient at supplying housing to those not in extraordinary circumstances.

Not for one minute though would we argue that the system is perfect. In fact I would be the first to put my hand up and say that it is so close to being broken it isn’t funny. The conflicts of interest that exist in the property industry are unfortunately all too common and in many instances have very little concern for the legacy that remains.

When projects get smaller and developers are in and out of the market, there is significantly less long term skin in the game. Whilst many State and Local governments push the “density is better” argument, large residential subdivisions and masterplanned communities generally ensure an optimal outcome due to the length of time the developer is involved. They cannot afford to deliver sub-par outcomes otherwise the long term viability and sustainability of the project suffers. If affordability is really the big problem being pushed above, perhaps the land supply issue identified in 2008 by Dr Donald Brash should be taken up with the State Government’s across the country. It is those institutions that determine individual growth boundaries. In essence, you reap what you sow. The cutting of grants is not the real problem.

Back to one of the conflicts of interest. When speaking recently at a finance convention, The RBA Governor very succinctly and wisely summarised some of the issues facing the banking sector. They apply equally to the property sector and I would suggest some of our politicians. “…(the) root causes seem to include distorted incentives coupled with an erosion of a culture that placed great store on acting in a trustworthy way.” Just because things can be sold, doesn’t mean that there is an end user. When town planners start spruiking apartment markets that have multiple years supply in front of them, you know that it is time to put the microscope over everything.

Our cycles will continue to get steeper through technological advances that allow people to buy property sight unseen with little to no knowledge on what the supply and demand equilibrium is. Greed will fuel this trend and our cycles will boom and bust more regularly. As Glenn Stevens noted, “In the end, though, you can’t legislate for culture or character. Culture has to be nurtured, which is not a costless exercise. Character has to be developed and exemplified in behaviour. For all of us in the financial services (Real Estate services sector) and official sectors, this is a never-ending task.”

Rant over.

The National Property Research Company

Level 1, 307 Queen Street

BRISBANE QLD 4000

Ph 07 3229 0111