Is Queensland’s Interstate Migration About to Boom?

Population growth for Queensland has long been one of its key economic drivers. It has provided considerable strength to the construction industry, driven strong retail output as well as given the civil sector some its largest projects in order to cope with the swelling population. However the population trends have changed considerably over the past decade.

Population Growth Queensland 1984 - 2014

One of the most obvious changes has been the significant increase to the international migration numbers. Given the timing of the mining boom and enormous skills shortage that existed at its peak, international labour was required to get many projects to completion on time...though maybe not necessarily on budget. Of real concern is that the 457 visa numbers are likely to continue the downwards trend. In August this year, the Australian reported that the 2013/14 457 visa’s were down 39.3% on the same time the previous year. For Queensland this is of enormous significance as many of these workers were located in regional centres that have short to medium term oversupply issues in the housing sector.

So whilst we have seen a very important contribution to Queensland’s economy through international migration, the same can not be said for interstate migration. In Lara Bingle’s disastrous tourism campaign, “Where the bloody hell are you?”, this sentiment could equally apply to interstate migration into Queensland.

Queensland Annual Net Interstate Migration 1982 - 2014

When you look at the numbers that surround net interstate migration, it is very clear that the economic contribution from this sector of population growth is far from the highs experienced in the late 80’s through to the mid nineties as well as the last peak reached in the early to mid 2000’s. In fact, net interstate migration is down by over 425% from the long term annual average of 24,725. However before we get too alarmist, because I know that some of the media will read this, the following graph will place a little perspective on the whole population mobility trends.

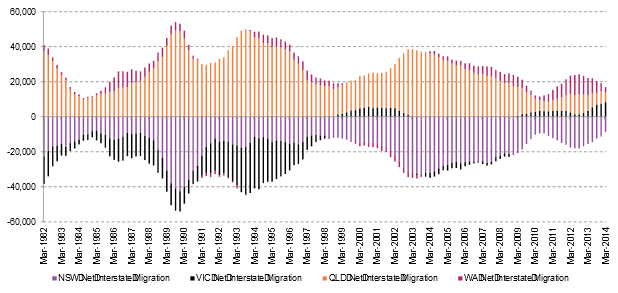

State Annual Net Interstate Migration 1982 - 2014

What we can see is that since the last peak in 2003-2004, the long term trend has been for a more stable population in terms of its movement. Whether there is merit in the argument regarding a more mobile work force where employees are happy to commute via aircraft and technology is definitely having an impact, but one that is difficult to measure. Teleconferencing is now done through Facetime, Skype or another derivation thereof. Computers can share information so people in different destinations can work through problems/strategies together whilst being thousands of kilometres apart.

There are a couple of other trends that also warrant discussion. The first is that NSW, a perpetual loser in net interstate migration movement is stemming the flow of people over its borders. On the flipside of that, is that Victoria since the advent of the GFC has actually been a winner in interstate migration gain. The author would argue that this has been to the detriment of Queensland. From 2010, Western Australia has been punching above its weight however this looks to be drawing to a close as mining also comes off the boil.

But in reality, the driving force behind the last interstate population boom in Queensland was not about the jobs. There is a common misconception that interstate migration is driven by employment. Now that may be true for other States, but it is not the case for Queensland.

Queensland Interstate Migration vs Employment Growth

As you can see, the correlation between growing employment numbers, the right vertical axis bears very little similarity to the left axis representing interstate migration. So whilst job growth was very strong from 2003 to 2007, interstate migration was consistently declining. The last decade in the short term rear view mirror at least highlights that whilst it is great to have strong employment, it won’t necessarily translate into greater population growth from across the border.

What would make the team at NPR Co. believe that the interstate migration pattern could change, and change quite dramatically? Sydney’s median house price could well be the key to a strong surge for Queensland, particularly SEQ.

Queensland Interstate Migration vs Sydney & Melbourne Median House Price (%)

In the early 2000’s, Brisbane house price was reasonably depressed when compared to both Sydney and to a lesser extent, Melbourne. At the time, Sydney’s median house price was more than double that of Brisbane, whilst Melbourne was almost 50% more expensive. The black line in the graph is actually the Brisbane median house price in comparison to both Melbourne and Sydney. What is clearly evident is that as the price differential between Brisbane and Sydney started to decline to a point where Sydney was a premium of less than 15% more expensive than Brisbane, interstate migration plummeted with it. Victorians stopped coming to Brisbane because it was a cost impediment to do so. By the time they had listed and sold their property, payed for an interstate removalist and then paid stamp duty and legal fees to buy a property of similar value in another state, their net position was actually worse.

As Brisbane house prices have remained relatively stable for the best part of five years, once again the median house prices are starting to favour Brisbane, and as a result there is every likelihood that net interstate migration to the Sunshine State will rebound as well.

Queensland Interstate Migration vs Sydney & Melbourne Median House Price (Prices)

Whilst it is acknowledged that Sydney is not currently twice as expensive as Brisbane, and realistically it is difficult to foresee this occurring in the current cycle, a price differential of more than $310,000 will prove attractive to many home owners and potential home owners. Contrary to popular belief, Queensland’s net interstate migration is fuelled by the younger end of the demographic spectrum rather than the older age groups. This is not surprising when the median house price argument is applied to those looking at buying their first home or starting a family. The pressure of mortgage debt in these early years is often quite daunting, a pressure that is far less in Queensland.

Because of the lag in population data, NPR Co will be very surprised if that by the end of 2014 the interstate migration numbers haven’t at worst doubled from their current low rates. With investment home loans more recently representing around 50% of all housing finance deals, the vacancy rates remain mostly very low in SEQ and some other regional centres. This can only happen if the population continues to expand, and we are willing to bet that is exactly what is happening.

As Sydney’s median house price continues to grow, Queensland should cheer them on as the outlook for Brisbane only gets better.

The National Property Research Company

Level 1, 307 Queen Street

BRISBANE QLD 4000

Ph 07 3229 0111