The Housing Recovery is Underway

Yesterday’s lending finance data released today shows that finance for owner occupier housing has turned the corner and continues to grow. The seasonally adjusted estimates place the increase at 1.3% over December which is a great result in what is typically a quiet time of the year.

Unfortunately the data is not so favourable for new home construction for rent or resale which showed substantial drops across all States. New home investment continues to frustrate businesses that are solely focussed on investment marketing. The reduced volumes of “spec houses” shows that whilst the recovery is underway, there is also a transition taking place. Owner occupiers are again starting to come to the fore. They have equity and now have the confidence to start making decisions.

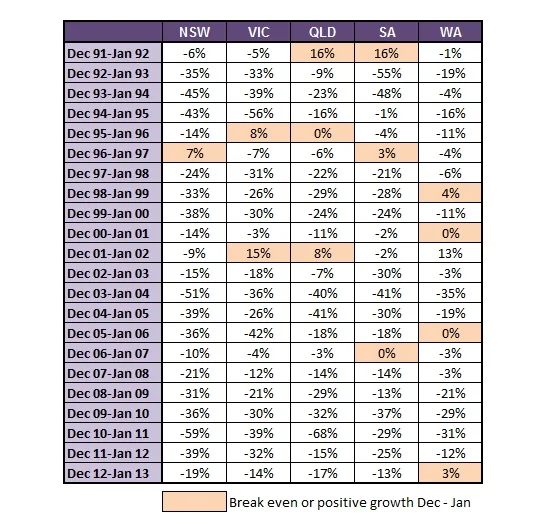

However the construction data shows that the downturn is seasonal in part and fairly typical across the whole of Australia. Over the past two decades, there has not been a single year when the whole of Australia has been up. The simple reality is that many people in the construction industry shut down over the Christmas and New Years break for three to four weeks. Any headline that suggests that the market is falling away is not taking into consideration the broader trends.

Table 1 : Construction for Rent or Resale by individuals.

However it is noted that the investment marketeers are now searching out the self managed super funds (SMSF’s) as the next niche market to sell into. This has come about as most of the “normal” investment marketing channels have dried up. The sales that were coming out of the mining communities, particularly those from Western Australia are much more difficult to source. Financial planners are also more interested in the equity markets and therefore those channels are also starting to look like low tide.

What the industry is about to see is a recovery in the neighbourhood real estate agencies. These businesses are again starting to get busier with open inspections beginning to draw higher levels of interest. There is a reality check that has occurred and both buyer and vendor expectations have narrowed.

2013 is the year where the owner occupiers will emerge as the dominant buyer in the marketplace. Expect to see plenty of golden retrievers in the advertising, happy families frolicking in a park and young couples drinking wine on the balcony of their inner city apartment or slurping coffees in the café located on ground floor.

The owner occupiers are back and the retail spending data is out there supporting it. Get the value proposition right and the sales will flow.

If you would like a member of our team to help with your business planning for 2013-14, please call our offices on (07) 3229 0111.

The National Property Research Co.

Ph (07) 3229 0111

Level 1, 307 Queen Street

Brisbane QLD 4000