Talk of Housing Bubble Premature

Today the ABS released the quarterly weighted average house price data series for Australia’s capital cities. All the media hype surrounding a property boom appears to be largely that, hype. Now don’t get me wrong, it is great to see the media in a positive frame of mind about the property sector, because clearly it has been years since we have seen that.

However today’s statistics demonstrate that the property recovery is still in its infancy in many centres and with the exception of Sydney (3.6% Qtr or 11.4% p.a), and some may argue Melbourne, is still relatively fragile. “The eight capital city weighted average increased 1.9 per cent in the quarter, for a total rise of 7.6 per cent over the last year. Other increases were in Melbourne (+1.9% Qtr or 6.8% p.a), Brisbane (+1.2% Qtr or 4.1% p.a), Perth (+0.2% Qtr or 8.6% p.a), Hobart (+1.4% Qtr or 1.1% p.a) and Darwin (+0.4% Qtr or 6.0% p.a), while Canberra (-1.2% Qtr or 0.6% p.a) and Adelaide (-0.6% QTR or 1.0% p.a). This is the first time since 2010 that the capital city average has shown four consecutive quarters of growth year on year," said Robin Ashburn from the ABS.

We are now starting to see many of those residential markets that have been struggling for several years, now gaining traction as “tyre kickers” become buyers. There is a sense of urgency starting to be created around low interest rates, generally sound employment conditions and an air of optimism from business. This has coincided with a change in government as the private sector looks to a period of greater stability.

Whilst the recovery in the residential market gains momentum, this is arguably being felt greatest in the established market which is again starting to show some price growth. New product whilst not having the same opportunities for increased prices given the gap between new and established, those projects are again making great monthly sales. However this may not continue in many of the capital city urban centres as land supply is often constrained and restricting supply. The most logical outcome will be smaller lots and higher prices. There is just no way around this unless there is a relaxation on planning boundaries or the general public comes to accept that medium rise infill projects will be the way of the future. This should not be read as an either-or ultimatum, it simply states that the population growth in many capital cities will have to be housed up, not out under current planning doctrines.

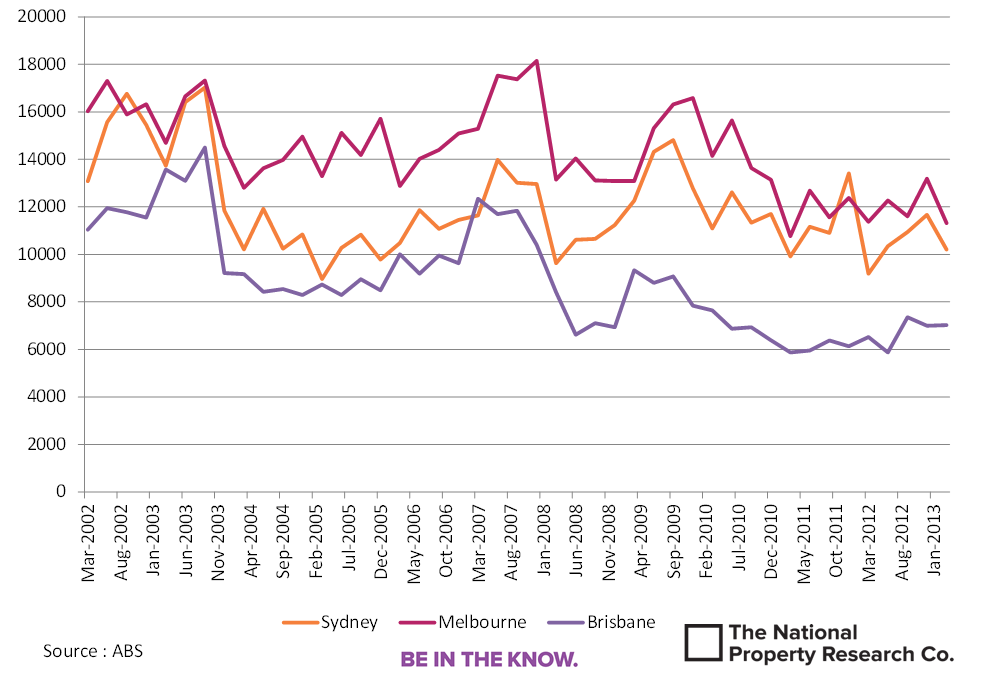

With regard to the established market, one would expect that under boom conditions, the volume of sales would be escalating significantly as they did in the lead up to the GFC. This is quite the contrary when the graph below demonstrates that the first quarter of the year saw relatively flat sales rates on the eastern seaboard. When the ABS releases the following two quarters, there is an expectation that the volume of sales will have increased but most markets have a long way to go before they reach their previous peaks. It is highly, highly unlikely that a housing asset bubble can form in six months, particularly given the stagnation in the real estate markets around the country up to that point.

The Number of Established House Transfers, Sydney, Melbourne, Brisbane.

From the perspective of the RBA, it is hard to imagine them looking favourably at increased house prices and concerns around bubbles if there is a genuine shortage of land. I use the word “genuine” because sometimes land within the urban footprint can take quite some time to gain the relevant approvals or is out of sync with the development pipeline for an area. The end result will however be the same. Higher prices that feed into the RBA’s modelling which is inevitably a contributing factor to pressure on interest rates and decreased affordability.

Increased interest rates will put pressure on the Australian dollar, something that the RBA has stated they would rather see abate in value, rather than increase. From this perspective, the RBA is caught between a rock and hard place if you believe that the housing market is starting to get out of sync with the rest of the economy. A position the author does not support.

Housing Finance Commitments, 2000 - August 2013.

Housing finance commitments also show that the market is showing signs of a rebound, but hardly a prolonged and extraordinary run of activity. In fact, In Queensland you would suggest that the market recovery has only just begun. The heights of the 2007 data for Brisbane would require a recovery in the order of 43% in volume to take place. A housing bubble based on finance data is a spurious one at that.

From the author’s viewpoint, it would be a shame to see a recovery in the residential sector eroded by factors that are within the control of various public authorities. Housing/construction activity is such a strong contributor to the economy in a significantly broad based way. It is unfortunate that various commentators are quick to suggest that a boom is underway before the facts actually support the phrase. It is also ridiculous to look at the housing sector in isolation from the rest of the economy. The RBA has stated that they want to see a recovery in the housing sector, retail and business as we transition out of a resource led economy to a more diversified business environment. As this starts to happen, the RBA will be glad that monetary policy has played a part. However they will be very reluctant to put the brakes on any recovery that is clearly only just beginning.

-Matthew Gross

The National Property Research Company

Level 1, 307 Queen Street

BRISBANE QLD 4000

Ph 07 3229 0111

Be In The Know – The National Property Research Co.