Million dollar house sales increase 178% in five years

Million dollar house sales remain a common benchmark in residential property. In the past it has represented a ceiling that made sales more difficult to achieve and defined where the dress ring circle suburbs were located. Over the last twenty years, house sales over one million dollars within SEQ have increased from just 50 sales in the first half of 2000 to 2,042 sales for the second half of 2019, the highest rate of sales for a half year on record.

2019 represented a very interesting year in that the Federal election was arguably one of the most divisive since the introduction of the GST or Workchoices. There were clear party lines on the treatment of personal assets with property being in the firing line of Labor and the coalition adopting a business as usual approach in broad, generic terms. The second half of 2019 saw the election result surprisingly favour the Coalition and an atmosphere of enthusiasm was again generated around the housing market which demonstrated a significant capacity for resilience.

When compared to the ASX 200, the total sales of million dollar homes in SEQ has loosely tracked the index providing a good indicator of how this sector of the market is likely to perform. The ASX 200 is generally a good indicator of individuals wealth and confidence in the broader economy. The sudden decline in 2020 due to the Pandemic has seen property volumes fall as well, however the resurgence in the ASX 200 and the rebound in the Australian Dollar have again appeared to place a floor under this market.

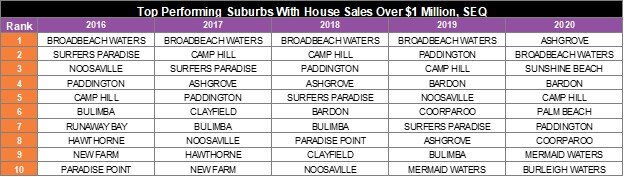

What is particularly noteworthy with the house price data is the dominance of the Gold Coast. Surfers Paradise was the suburb leading the most sales over $1 million in SEQ from 2000 to 2009. It again regained the title in 2013 and 2015 making it the most prolific suburb for housing over the benchmark price throughout the recording period. It wasn’t until 2014 that a Brisbane suburb attained the mantle of the most house sales over $1 million being New Farm and once more in 2020 so far being Ashgrove, though this could change as the year evolves. At no point in the past twenty years has a suburb outside of the Gold Coast and to a far lesser extent Brisbane achieved that title, despite the significant exposure to the Brisbane River or elevated leafy suburbs that abound.

Quite clearly SEQ is a coastal population and buyers are paying big money to be close to the beaches and canals. Surfers Paradise, Broadbeach Waters and Paradise Point dominate the top three positions over the last two decades. Surprisingly Noosa Heads, Noosaville and Sunshine Beach don’t feature more prominently, however this has more to do with the size of their markets and arguably the length of time that people hold their properties for. In some respects, it is also a reflection of their smaller economy.

If consideration is given to the concept of being able to work from home more often; if that is what emerges in a post pandemic reality; then the coastal locations are more likely to come under greater buying pressure. People will sacrifice a longer commute for three days a week if it means their mornings, afternoons and weekends are spent in a location that they may consider to be more lifestyle oriented. This may stretch existing infrastructure, particularly trains from the Gold Coast which operate at or near capacity during peak hour, broadband networks that may not have been designed for the volume and or size of content that is being moved from computer to computer/phone to phone, or the Bruce Highway from the Sunshine Coast that is probably quicker by skateboard from North Lakes some mornings. Of all of the near city suburbs in Brisbane (Queensland’s capital city), to not dominate the top ten list yearly is both a positive in terms of affordability if you have a budget over $1 million; and perhaps an indictment that many have some way to go in providing genuine lifestyle attributes apart from a shorter commute to the CBD.

Despite the increase in the volumes of house sales over $1 million dollars from 2000, there has actually been an average price fall from the previous cycle of 2005 to 2007. In part this is a reflection of the number of homes that through simple capital appreciation over time have eclipsed the benchmark price of $1 million whilst the volume of prestige properties trading hands has not kept pace. By default, the top end of the market does not appear to have gained at the same rate as the more aspirational middle to upper socio economic buyers. Combined with this has been monetary policy that has been more favourable and supportive to those purchasers that can service larger debts and have built up substantial equity over time.

The outlook for this buyer cohort remains sound for 2020. The biggest problem may well be the limited choice of stock available given that many may choose not to buy and sell in this market, simply because they don’t have to. However the first quarter of 2020 was very strong, the second quarter appears reasonably sound with continued improvement expected for the balance of the year, assuming no more shocks or a second Covid-19 wave is encountered. On balance, the preliminary data again suggests a resilience that many “commentators” weren’t expecting at the start of the pandemic and were only too happy to preach doom and gloom without any solid evidence…so basically a stab in the dark.

Matthew Gross | Director | mgross@nprco.com.au