Residential Recovery?......Not Yet

No one wants to be that guy, the glass half empty guy. But the calls of a recovery in the housing market may be somewhat premature, perhaps even wishful thinking. The challenges in Australia’s real estate market are far more complex than is the price going up or down, but even based on those metrics, it is difficult to see a recovery or even the bottom of the cycle for some cities at the time of writing.

Sale prices in Sydney and Melbourne are back to values seen four years ago, eating up an enormous amount of equity. If you bought at the peak, Sydney’s median house price has fallen by almost 24% and lost over $200,000. Melbourne by contrast has declined by almost 15% with the median house price falling by $97,000. There should be no surprise that retail numbers are soft and many people are reducing their debt levels through higher repayments rather than spending simply to try and stay ahead of a market that is correcting.

Brisbane however has seen very little change in its median house price over the past decade with a very subdued post GFC recovery. It is this fact which has led some commentators to forecast as high as 20% growth over the coming three years. It should be noted though, that if Sydney and Melbourne continue to experience price declines, it is highly probable that Brisbane will also start to show signs of weakening in some areas. Whilst the author is not inclined to disagree in full with the price growth expectations, the timeframe may be somewhat ambitious given the headwinds being felt nationally and globally. With China announcing more downgrades to the performance of its economy, a failed financial institution and a trade war with America, Australia’s largest trading partner will also be looking at what levers it can pull to stimulate its own economy. This may in fact be easier under their form of government. However there comes a point when even the Chinese economy can only sustain just so much debt.

The recovery is also difficult to see in the sales volume numbers as well. Brisbane’s housing market has dropped to numbers lower than the worst period in the GFC with both Sydney and Melbourne fairing substantially worse. Sales volumes for the latest quarter show both of those cities at levels that are the lowest in over two decades. Sydney and Melbourne house sales have declined from their respective peaks by 57%. The current decline is a deficit of over 9,000 sales difference from each city when comparing the current quarter to their respective peak quarters. The flow through to the broader economy is highly significant and one of the reasons both professional services, construction and retailing is suffering. Financiers must also be starting to feel the pinch with a weight of funds looking for a home, pardon the pun.

Despite the fact that Australia has been in a stable or falling interest rate environment throughout the post GFC period, the difference between the official Cash Rate and the standard variable rate mortgage remains out of kilter. For much of this period, the RBA governor has defined the international borrowing conditions for financiers as stable and accommodating. Despite this, the RBA governor has had to take on the unusual position of asking banks to pass on the interest rate cuts in full as well as prompt the government to shy away from the promise of delivering a surplus to the economy and spend it on productivity gaining infrastructure programs that will deliver surpluses at a later date, but potentially stop or reduce the chances of entering a recession. The general public are used to broken promises, at least this one would appear to have very good cause.

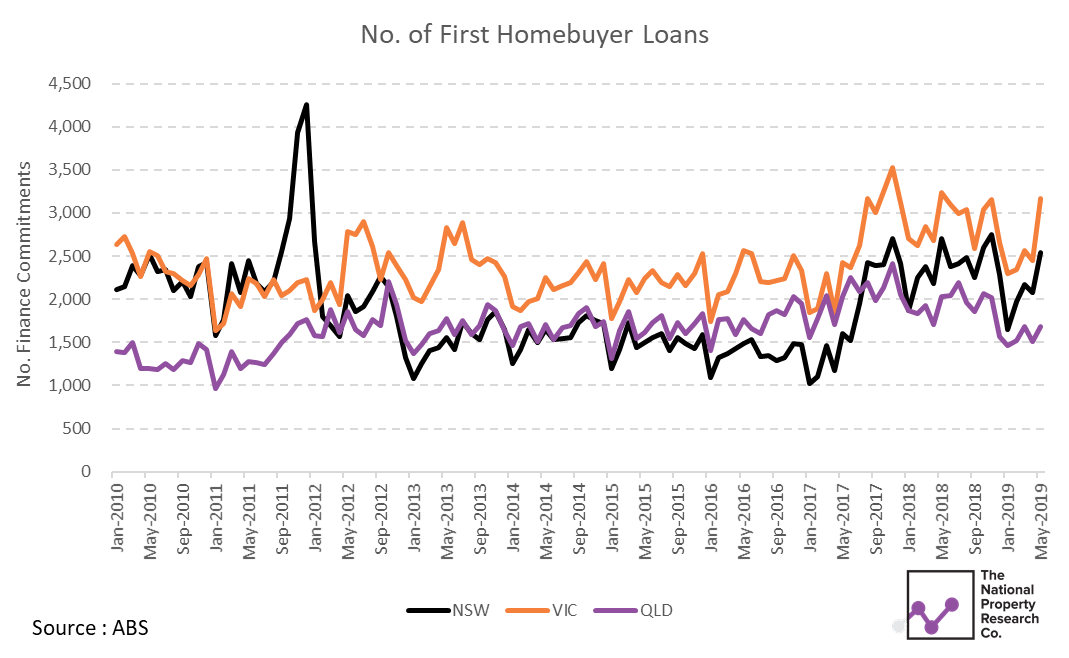

Encouragingly, first home buyers are starting to show signs of rebounding and whilst generally the author is an advocate for leaving the market to sort itself out, there has been so much interference of late through lending policies, increasing land tax rates, declining foreign buyers and higher taxes for those that do choose to purchase, that revisiting policy to this buyer type is arguably warranted. That is at a State Government level, acknowledging that federal based the national FHB scheme is being revisited as part of the fallout from the election in May. However, it should be noted that the increase in first home buyers is in part due to the declining house prices which have alone stimulated some purchaser appetite. Access to finance is another point of contention to be discussed at a later point in time. Suffice to say that many fringe master-planned communities have seen their sales rates more than halve through finance and valuation related issues.

The positive out of the First Home Buyer increase is that they may place a floor under the market. When this happens, expect investors to return in force which initially won’t drive prices up, but will get sales volumes back closer to the longer term averages. The other significant benefit of FHB’s returning to property is that many house builders will start to fill their forward book again which has been quite shallow in the current market conditions.

Whilst unemployment rates have reflected strong performances in NSW and VIC, QLD by contrast has been relatively lacklustre in creating job opportunities. Having stated that, there is concern that the current cycle of low unemployment rates could slowly unwind which is causing some commentators to speculate that the property market has not run its full course just yet. The coming six months will certainly provide a clearer picture, but again, there are potential headwinds associated with Australia’s major trading partner in China watching their economy soften at the same time as defending a trade war with the United States. Much of Australia’s resources in terms of coal and iron ore get consumed by China; which could potentially take the economic policy of building more infrastructure and thereby demand goes up, or alternatively consolidate their position, reduce debt and expenditure and by default, demand for Australia’s commodities softens. This scenario is still playing out; however, it will impact the unemployment rates above and again reiterates the RBA suggestion that infrastructure spending in Australia could be lifted to create more jobs and remove some of the reliance on international third parties.

On a slightly more positive note, it would appear that there could be some relief for wage earners with a slight uptick in incomes. Combined with rate cuts and some income tax relief, there is real potential for certain aspects of the economy to experience a gradual firming, particularly retail. However, this may well be more pronounced in the States outside of NSW and VIC where debt consolidation around mortgages is less of an issue given that house prices have been considerably more stable. The fact that the nation is now starting to find some relief in wage increases is a highly important indicator and will be a contributor to seeing CPI return to the preferred 2%-3% range.

Somewhat surprisingly, consumer confidence has started to trend down which is contrary to improving wage growth. What this is telling policy makers is that though some indicators may be improving, issues surrounding personal wealth, employment conditions and opportunities are outweighing the positives. If you lived in Sydney and watched your personal wealth decline by 20% or thereabouts over a couple of years due to the house price correction, chances are this is going to weigh heavily on your outlook. This isn’t helped by states like WA and the Perth house price which has gone from the most expensive in Australia to the cheapest in Australia. Surely a recovery has to be just around the corner. The author suspects that when this trend does reach the bottom of its cycle, a more positive turn around in the graph above will be forthcoming. The ASX will also be a sound indicator as well.

So what are the takeaways?

Traditional economic theorists are very much left scratching their heads. Unemployment rates are generally quite good around the nation, less so though in many regional centres. Interest rates are low and credit is cheap, though accessing it has been problematic for many would be purchasers over the past 24 months. The correction in many housing markets has meant that First Home Buyers are again starting to enter the market. Residential investors have largely gone from many markets, though Brisbane would be the exception to the rule on the East Coast where purchasers are far less concerned about a correction given the flat performance of the housing and apartment market over the past decade. Wage price growth is improving which should be stimulating the retail sector, but sadly this is not currently happening. The flight to Gold as an asset class shows that there is nervousness in the economy with this precious metal having recently broken the $2,000 an ounce mark in Australia. The falling Australian dollar is driving international tourism and domestic tourism, however Australians are still holidaying overseas at record or near record levels which suggests that there is a reasonable level of confidence in the future, given the size of this discretionary spend.

Quite rightly there isn’t one answer to how 2019 will close out the balance of the year. Talk of a residential cycle having bottomed out in Sydney and Melbourne is premature; however it is probably closer to the truth for Brisbane and even Perth for that matter. The upshot of this instability is that sales people are no longer order takers and developers need to make sure their product meets the market and their message is on point. The basics are no longer enough and it will be during the next couple of years when projects will make or break developers reputations. Market intelligence continues to grow in importance as buyers become increasingly more discerning given the multitude of offers on the table.