Queensland Residential Land Sales 2012 Report Card

The land sales market for 2012 has proven to be extremely difficult for every major developer in Queensland. A recent survey undertaken by The National Property Research Co. demonstrated that only one firm of the 13 surveyed actually made budget in terms of their sales forecasts from January to December. The next closest was a 13% shortfall through to a whopping 50% shortfall.

Whilst these numbers are scary in terms of returns on asset and profitability, it did demonstrate a number of intricacies in the market.

The first issue that plagued developers in 2012 was the challenge of getting valuations to stack up. This saw some corridors in South East Queensland with fall over rates exceeding 60%. Whilst incredibly demoralising for sales staff, these fall overs have a much broader impact on the local economy. New homes generate employment from the ground up. This starts at the civil construction side in preparing the land plus the consultants required to make it happen right through to the completed product where the individual owner needs to buy carpets, white goods, plants etc. In addition to this, the flow on through the local community is also impacted. Greater numbers of residents usually converts into a greater range of services and by default, more employment. The development and construction industry remain the grass roots of the broader economy.

The second issue that impacted many developers was a lack of geographical diversification. Those developers that had exposure to the larger regional centres generally experienced better sales results. So whilst South East Queensland was finding the going tough, those firms with greater geographical exposure often had their sales budgets topped up.

The third issue was that the level of mortgagee in possession sales made development incredibly difficult. In fact, it appeared that there would be a negative spiral as developers who were completely solvent had to compete directly with this stock. The prices that were being achieved for mortgagee stock was usually well below the build cost in the broader market. Without sales coming in for the solvent developers as a result, their capacity to make sales diminished with it which potentially lined them up for the same fate. Fortunately 2012 saw much of this stock liquidated through the market.

The fourth issue was the availability of finance. This actually had a two pronged effect. Financiers were reluctant to lend money on many projects for fear of not getting an adequate return. Conversely the hurdles put in place to achieve finance squeezed most of the middle tier developers out of the market.

Borrowers for general residential property also found it more challenging to gain finance. This was particularly apparent for first home buyers who required a larger deposit. This was not helped with the First Home Owners Construction Grant (now the Great Start Grant) which missed the mark in stimulating new home sales in most corridors.

If you were an investor in 2012, valuers appeared to be passing a closer eye over those deals. This was often a result of Investment Marketers charging high commissions that the valuers perceived to be added to the price of the property, rather than coming off the price of the property. There were many winners and losers in this space; however it is suspected that the lost property deals far outweighed the successful ones.

Interest rates continued to keep the market on edge. It didn’t matter how much the RBA cut rates, the top four banks were reluctant to pass it all on. This sent nervous jitters through the market. In fact at a recent API lunch where Westpac Chief Economist Bill Evans suggested that the softening in interest rates had minimal impact on the market, Matthew Gross, Director of The National Property Research Co. commented that perhaps the reason for this was that they weren’t passed on in full.

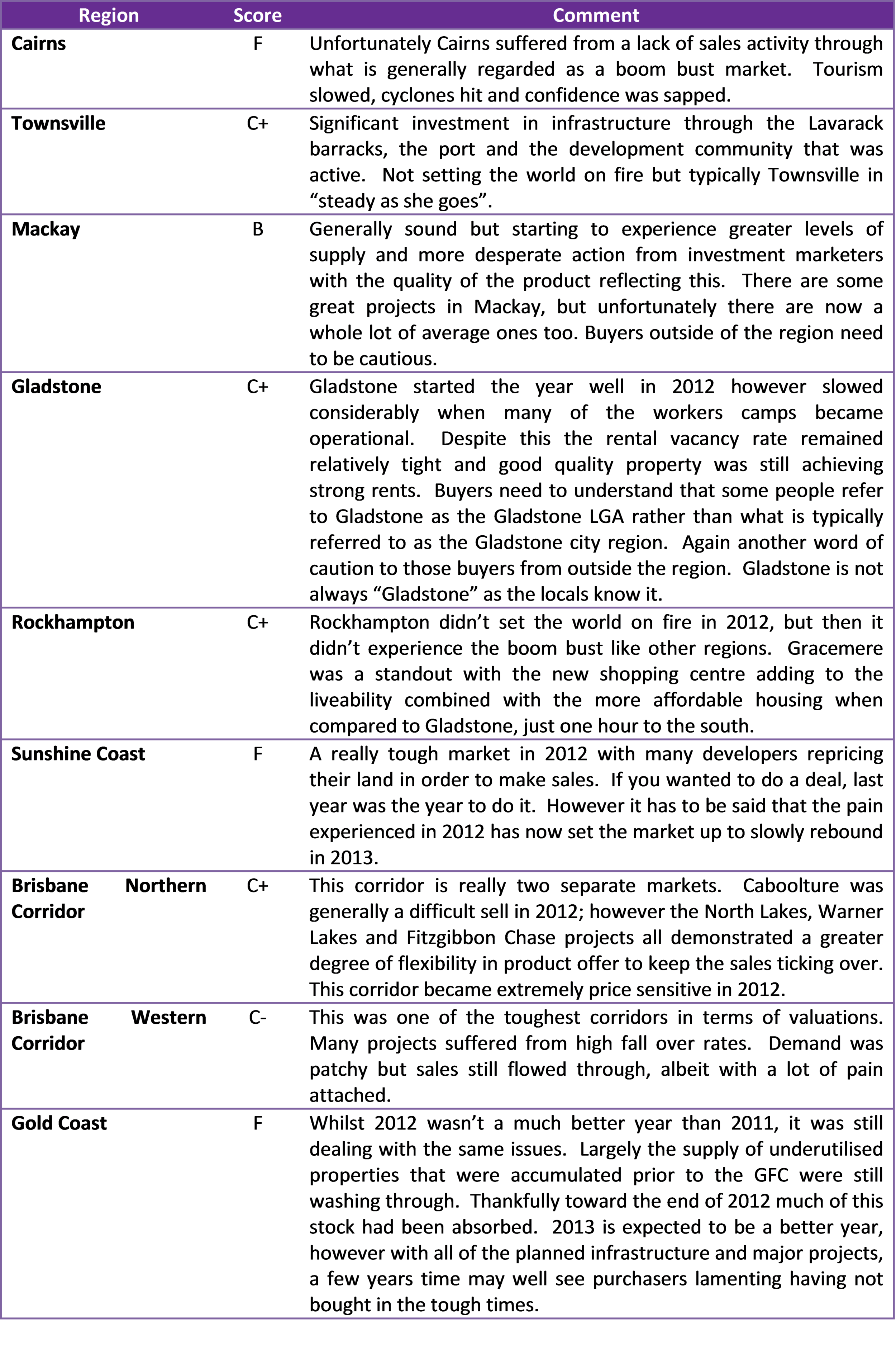

Whilst we acknowledge that the market was tough, how would we rate the various residential Land markets for 2012?

Whilst the above table is a generalisation, it is acknowledged that some projects and developers faired better than others. Niche markets will always find opportunity in diversity and generally this is achieved through good quality independent research.

Be in the know – The National Property Research Co.

The National Property Research Co.

Level 1, 307 Queen Street (GPO Box 1468) Brisbane QLD 4000

Ph: (07) 3229 0111